The sense of pride you’ll feel when you purchase a home can’t be overstated. For first-generation homebuyers, that feeling of accomplishment is even greater. That’s because the pride of homeownership for first-generation buyers extends far beyond the homebuyer. AJ Barkley, Head of Neighborhood and Community Lending for Bank of America, says:

“Achieving this goal can create a sense of pride and accomplishment that resonates both for the buyer and those closest to them, including their parents and future generations.”

In other words, your dream of homeownership has far-reaching impacts. If you’re about to be the first person in your family to buy a home, let that motivate you throughout the process. As you begin your journey, here are three helpful tips to make that dream come true.

1. Reach Out to a Real Estate Professional

It’s important to reach out to a trusted advisor early in your homebuying process. Not only can an agent help you find the right home, but they’ll serve as your expert advisor and answer any questions you might have along the way.

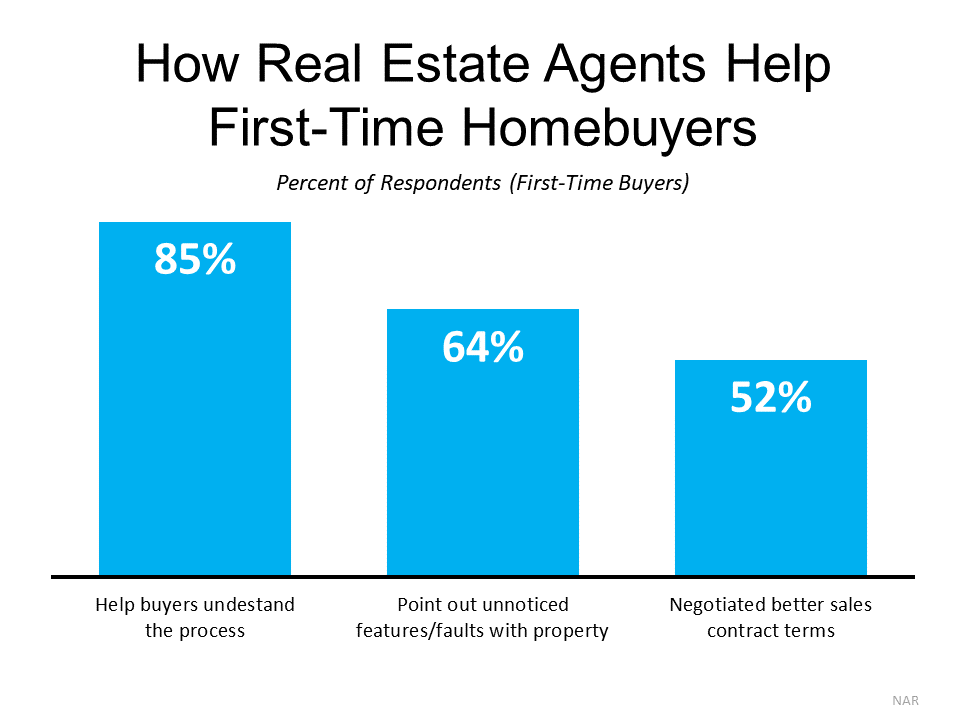

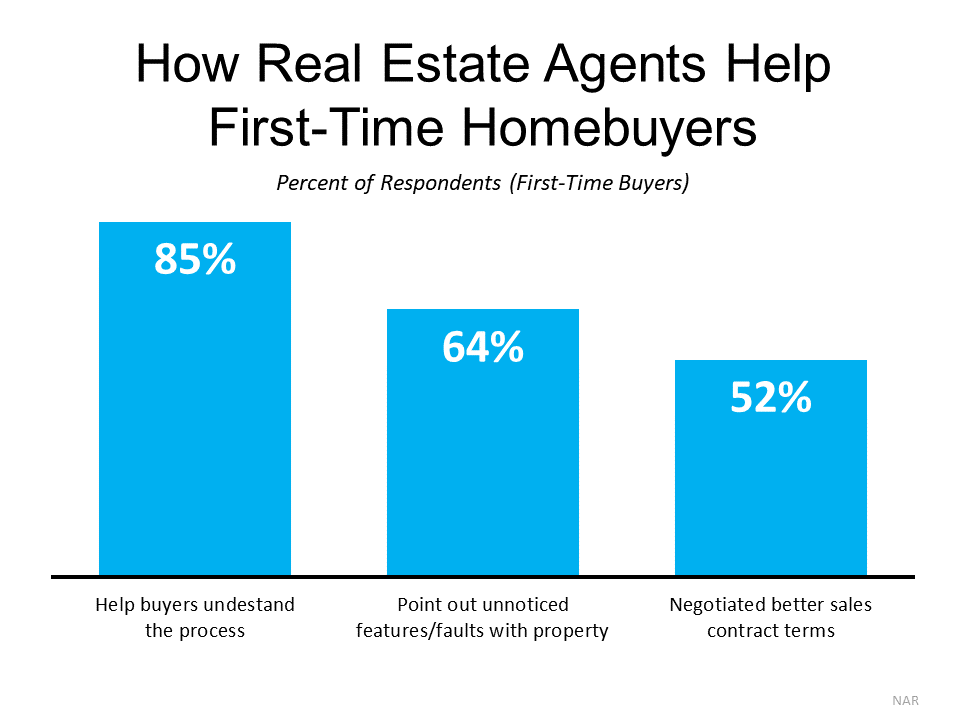

The latest Profile of Home Buyers and Sellers from the National Association of Realtors (NAR) surveyed first-time homebuyers to see how their agent helped them with their home purchase (see chart below):

As the graph shows, your agent is a great source of information throughout the process. They’ll help you understand what’s happening, assess a home’s condition, and negotiate a contract that has the best possible terms for you. These are just some of the reasons having an expert in your corner is critical as you navigate one of the most significant purchases of your life.

2. Do Your Research and Know What You Can Afford

The second piece of advice for first-generation homebuyers is practical: do your research so you know what you can afford. That means getting your finances in order, reviewing your budget, and getting pre-approved through a lender. It also means learning the ins and outs of what it takes to pay for your home, including what you’ll need for a down payment.

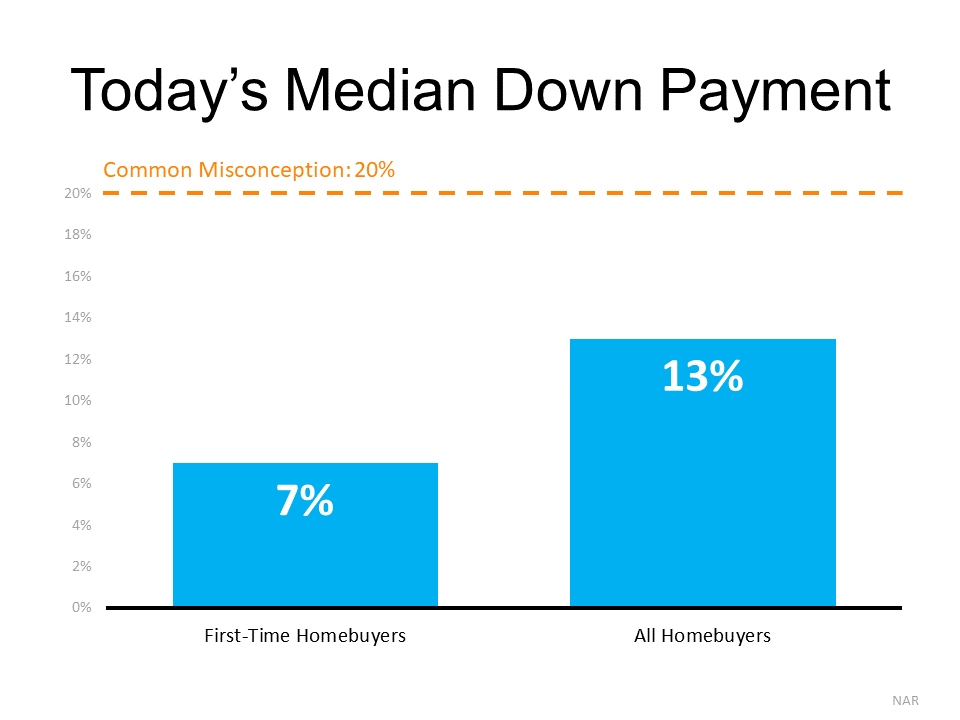

Many homebuyers believe the common misconception that you can’t purchase a home without coming up with a 20% for a down payment. As Freddie Mac says:

“The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.”

The chart below shows what recent homebuyers have actually put down on their purchases:

On average, first-time buyers only put 7% down on their home purchase. That’s far less than the 20% many people believe is necessary. That means your down payment, and your home purchase, may be in closer reach than you realize. Keep that in mind as you work with a real estate professional to better understand what you’ll need for your purchase.

3. Don’t Lose Sight of What Home Means to You

Finally, it’s important keep in mind why you’re searching for a home to begin with. Overwhelmingly, first-generation homeowners recognize the financial and non-financial benefits of owning a home. In fact, in a recent survey:

- 73% of first-generation homeowners say the safety and security homeownership provides is increasing in importance.

- Nearly two-thirds of first-generation homeowners say the importance of building equity in a home is growing more important as well.

As AJ Barkley explains:

“For many first-generation homeowners and their families, homeownership has a unique importance, given the collective efforts to overcome financial challenges that can often span generations…”

Bottom Line

If you’re a first-generation homebuyer, being prepared and working with a trusted expert is key to achieving your dream. Let’s connect today so you can get started on your path to homeownership.

You might also enjoy reading…